Πίνακας Περιεχομένων

- Εκτενής Περίληψη: Βασικές Γνώσεις για το 2025–2030

- Παγκόσμια Πρόβλεψη Αγοράς: Προβλέψεις Ανάπτυξης και Κίνητρα

- Καινοτόμες Τεχνικές Κατάθεσης: ALD, CVD και Προόδους στην Εξάτμιση

- Κύριοι Παίκτες και Στρατηγικές Συμμαχίες

- Εστίαση Εφαρμογών: Ημιαγωγοί, Μπαταρίες και Επικαλύψεις

- Βελτιστοποίηση Διαδικασίας για Υπο-Λεπτές Ταινίες

- Εξέλιξη Εφοδιαστικής Αλυσίδας: Πρώτες Ύλες και Βιωσιμότητα

- Κανονιστικό Πλαίσιο και Βιομηχανικά Πρότυπα

- Αναδυόμενες Τάσεις και Διαταραγμένη Έρευνα & Ανάπτυξη

- Στρατηγική Προοπτική: Ευκαιρίες και Προκλήσεις για το Μέλλον

- Πηγές & Αναφορές

Εκτενής Περίληψη: Βασικές Γνώσεις για το 2025–2030

Η περίοδος από το 2025 έως το 2030 αναμένεται να witness notable advancements in fine vanadium nitride (VN) film deposition technologies, driven by expanding applications in electronics, hard coatings, and energy storage. The growing demand for high-performance, wear-resistant coatings in cutting tools and microelectronics is a major catalyst, prompting both established manufacturers and technology innovators to refine deposition methodologies for enhanced film quality, scalability, and process efficiency.

Key deposition techniques—such as physical vapor deposition (PVD), chemical vapor deposition (CVD), and atomic layer deposition (ALD)—are undergoing iterative improvements to address the unique challenges of vanadium nitride. Leading equipment manufacturers are investing in precision control systems to enable sub-nanometer film thickness and uniformity across larger substrate areas, a prerequisite for advanced semiconductors and next-generation battery components. Companies like ULVAC and Oxford Instruments are actively expanding their process portfolios to support VN deposition at industrial scale, leveraging their expertise in vacuum and plasma technologies.

Recent events in 2024–2025 underscore a trend toward hybrid and plasma-enhanced deposition methods, enabling lower processing temperatures and improved integration with sensitive substrates. This is particularly relevant for energy storage applications, where thin, conductive VN films are sought for supercapacitor electrodes and advanced lithium-ion battery architectures. The adoption of advanced in-situ monitoring and process analytics—provided by companies such as Buehler and Thermo Fisher Scientific—is accelerating process optimization, ensuring consistent film quality and reproducibility at scale.

The supply ecosystem is also evolving, with specialty chemical suppliers like American Elements and Alfa Aesar strengthening the reliability and purity of vanadium nitride precursors to support high-yield deposition processes. Strategic partnerships between material suppliers, equipment makers, and end-users are becoming more common, aiming to shorten development cycles and lower the cost barriers for commercial adoption.

Looking ahead to 2030, the outlook for fine VN film technologies is robust, underpinned by continued R&D investment, integration into emerging device architectures, and increasing cross-sector collaboration. The market is expected to move toward more modular, automated deposition platforms, enabling flexible manufacturing and rapid prototyping for both established and nascent VN applications. As environmental and energy efficiency regulations tighten globally, sustainable process innovations—such as low-waste precursor delivery and energy-saving plasma sources—are anticipated to become industry benchmarks.

Παγκόσμια Πρόβλεψη Αγοράς: Προβλέψεις Ανάπτυξης και Κίνητρα

The global market for fine vanadium nitride (VN) film deposition technologies is poised for notable growth in 2025 and the ensuing years, propelled by advancements in thin-film manufacturing methods and rising demand across multiple high-value sectors. Fine vanadium nitride films, prized for their exceptional hardness, corrosion resistance, and electrical conductivity, are increasingly utilized in applications such as cutting tools, microelectronics, and energy storage systems.

One of the principal drivers underpinning market expansion is the ongoing innovation in physical vapor deposition (PVD) and chemical vapor deposition (CVD) techniques. Major equipment manufacturers, such as ULVAC and Oxford Instruments, are developing highly controlled PVD and CVD platforms capable of producing ultra-thin, uniform vanadium nitride films. These advancements enable precise control over film stoichiometry and microstructure, meeting the stringent requirements of the semiconductor and electronics industry. Recent product launches and upgrades that target advanced materials, including VN, are expected to increase adoption in Asia-Pacific and North America—the two leading regions for thin-film technology investment.

The rise of electric vehicles (EVs) and renewable energy systems is fueling demand for vanadium nitride films in energy storage devices, particularly as potential electrodes in lithium-ion batteries and supercapacitors. Companies such as Sumitomo Chemical and Hitachi High-Tech Corporation have signaled ongoing research and process development in advanced vanadium-based coatings aimed at improving energy density and cycle life in next-generation batteries.

Additionally, the global push for sustainable manufacturing and higher-efficiency industrial tooling is leading to greater use of VN coating technologies in the metalworking sector. Tool manufacturers are collaborating with leading deposition equipment makers to develop wear-resistant, high-performance coatings for cutting and forming tools, with Hardide Coatings among those expanding their portfolio with advanced nitride film solutions.

Looking ahead to 2025 and beyond, the outlook for fine vanadium nitride film deposition technologies is robust. Market momentum is expected to be sustained by increased R&D investments, the emergence of new application areas, and strategic partnerships between material suppliers and technology companies. With continued improvements in deposition equipment and material quality, the sector is well positioned for accelerated adoption in both established and emerging high-tech domains.

Καινοτόμες Τεχνικές Κατάθεσης: ALD, CVD και Προοδους στην Εξάτμιση

The advancement of fine vanadium nitride (VN) film deposition technologies is witnessing significant momentum as the electronics, cutting tools, and energy storage industries demand higher performance coatings. In 2025, three main deposition techniques—atomic layer deposition (ALD), chemical vapor deposition (CVD), and sputtering—stand at the forefront of innovation for producing ultrathin, high-purity VN films with tailored properties.

ALD continues to gain traction due to its atomically precise thickness control and excellent conformality over complex 3D structures. Recent developments focus on lowering process temperatures and enhancing precursor delivery to facilitate VN growth on temperature-sensitive substrates, such as those used in microelectronics and battery components. Equipment manufacturers like Beneq and Picosun are expanding their ALD tool capabilities to support nitride film deposition, including vanadium-based chemistries. These advancements are critical for applications in gate dielectrics and protective coatings where high uniformity and reduced contamination are paramount.

CVD remains a preferred technique for high-throughput industrial coating, offering robust film adhesion and scalability. In 2025, innovation is centered around optimizing gas-phase precursors and plasma assistance to achieve higher film densities and smoother surfaces at lower processing temperatures. Companies such as Oxford Instruments are refining CVD reactors and process modules to meet the stringent demands of the semiconductor and hard coatings sectors. CVD-deposited VN films are increasingly utilized in wear-resistant coatings for cutting tools and diffusion barriers in microelectronics, benefiting from ongoing improvements in precursor chemistry and process control.

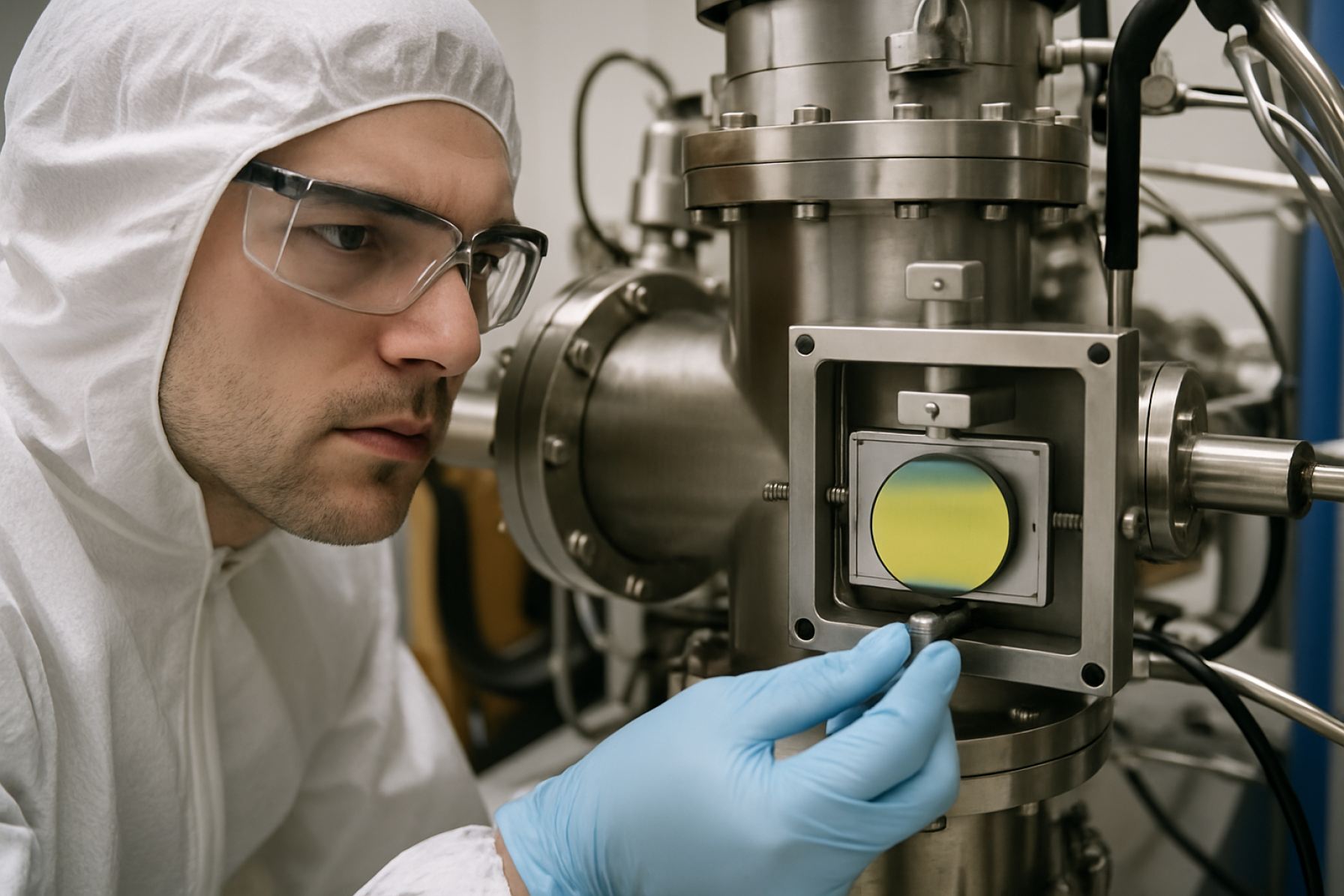

Sputtering, particularly magnetron sputtering, is advancing rapidly for fine VN film production, offering superior control over stoichiometry and microstructure. The ability to deposit VN at lower substrate temperatures and achieve precise thicknesses is driving interest in this method for both research and commercial applications. Leading suppliers such as Plassys and ULVAC are enhancing their sputtering systems with advanced process monitoring and target materials specifically designed for nitride deposition.

Looking ahead, integration of in situ diagnostics, such as real-time spectroscopic ellipsometry and plasma emission monitoring, is expected to further improve process control and enable the fabrication of VN films with customized electrical and mechanical properties. The convergence of these technologies is anticipated to accelerate the adoption of fine VN coatings in next-generation electronics, energy devices, and high-performance tooling throughout the latter half of the 2020s.

Κύριοι Παίκτες και Στρατηγικές Συμμαχίες

The landscape for fine vanadium nitride (VN) film deposition technologies in 2025 is marked by the emergence of leading players with strong expertise in advanced physical vapor deposition (PVD) and chemical vapor deposition (CVD) processes. The demand for high-purity VN films in electronics, hard coatings, and energy storage is prompting significant investments and strategic collaborations among established materials companies, semiconductor equipment manufacturers, and specialty chemical suppliers.

Key industry leaders like ULVAC and Advanced Micro-Fabrication Equipment Inc. (AMEC) have continued to innovate in vacuum deposition systems, targeting uniform, nanometer-scale VN coatings. Both companies have highlighted, in recent corporate updates, their focus on modular deposition platforms and process optimization for transition metal nitrides, including vanadium nitride, to serve next-generation semiconductor and energy applications.

On the specialty chemicals side, Ferroglobe and Treibacher Industrie AG remain prominent suppliers of high-purity vanadium compounds and targets, enabling precise film growth via magnetron sputtering and plasma-enhanced CVD. Their supply chain integration and close collaboration with deposition equipment manufacturers are pivotal for maintaining film quality and scaling up production.

Strategic alliances continue to shape the sector. Recent joint ventures between equipment makers and materials producers are accelerating the commercial readiness of fine VN coatings for emerging markets, such as solid-state batteries and protective microelectronics. For instance, technology partnerships with vertically integrated companies—like those seen between ULVAC and materials suppliers—are expected to expand in 2025, focusing on pilot lines and co-development of deposition recipes tailored to customer devices.

- 2025 anticipates expanded pilot production of vanadium nitride films in East Asia, driven by semiconductor fabs and battery component manufacturers leveraging proprietary PVD/CVD tools from companies such as AMEC and ULVAC.

- Material supply agreements, including high-purity vanadium targets from Treibacher Industrie AG, are being formalized to support the needs of both established and emerging deposition lines.

- Cross-industry alliances involving energy storage OEMs, advanced coating providers, and equipment manufacturers are projected to intensify, aiming for rapid qualification and scale-up of VN film processes for lithium-ion and solid-state battery electrodes.

Looking ahead, the next few years are likely to see further consolidation among deposition equipment leaders and specialty material suppliers, with strategic partnerships accelerating the commercialization of fine vanadium nitride films for advanced technology sectors.

Εστίαση Εφαρμογών: Ημιαγωγοί, Μπαταρίες και Επικαλύψεις

Fine vanadium nitride (VN) film deposition technologies have gained significant momentum in 2025, with applications spanning advanced semiconductors, cutting-edge batteries, and high-performance coatings. As device miniaturization and energy efficiency drive materials innovation, the demand for high-purity, ultra-thin VN films has escalated. The primary techniques for depositing fine VN films include reactive sputtering, atomic layer deposition (ALD), and chemical vapor deposition (CVD), each offering unique advantages for specific application domains.

In the semiconductor industry, the drive towards sub-5 nm node devices has placed stringent demands on diffusion barriers and conductive layers. VN films, with their excellent thermal stability, low resistivity, and strong diffusion barrier properties, are increasingly favored. Recent advances in ALD have enabled atomic-level thickness control, crucial for next-generation logic and memory devices. Equipment suppliers such as ULVAC and Oxford Instruments are actively developing ALD and sputtering platforms capable of depositing conformal VN layers with thicknesses below 10 nm, tailored for high-aspect ratio features.

In battery technology, vanadium nitride is attracting attention as an electrode material in both lithium-ion and sodium-ion systems. Its high electrical conductivity and redox activity make VN films suitable for fast-charging and high-capacity storage devices. Research partnerships with equipment providers like Veeco Instruments are exploring CVD and plasma-enhanced CVD (PECVD) processes to produce fine-grained VN coatings that improve electrode cycling stability and energy density. Pilot manufacturing lines initiated in 2024 are expected to advance to commercial-scale production by 2026, with early results indicating enhanced battery performance when compared to traditional carbon-based films.

For protective and decorative coatings, fine VN films offer superior hardness, corrosion resistance, and wear protection. Tooling and component manufacturers are leveraging magnetron sputtering technologies from companies like Ionbond to deposit dense VN films on cutting tools and machine parts, extending service life and reducing maintenance costs. These coatings are being adopted in aerospace, automotive, and medical device sectors, with ongoing collaborations focusing on scale-up and process repeatability.

Looking ahead, the intersection of digital manufacturing, in-situ process monitoring, and machine learning is expected to further refine VN film deposition control, enabling tailored film properties for specific end-use cases. As demand for advanced materials grows, the next few years will likely see expanded adoption of fine VN films across multiple high-tech sectors, underpinned by continued innovation in deposition equipment and process integration.

Βελτιστοποίηση Διαδικασίας για Υπο-Λεπτές Ταινίες

Process optimization for the deposition of ultra-fine vanadium nitride (VN) films is a rapidly evolving area, driven by increasing demands from industries such as microelectronics, hard coatings, and energy storage. The current focus, especially leading into 2025 and beyond, is on developing deposition technologies that offer precise control over film thickness, composition, and microstructure, while maintaining high throughput and scalability.

Physical Vapor Deposition (PVD) techniques, particularly reactive magnetron sputtering, continue to dominate the VN thin film market. Recent advancements have centered on fine-tuning parameters such as sputtering power, substrate bias, and nitrogen partial pressure to achieve nanometer-scale uniformity and improved adhesion. Leading vacuum technology providers, including Leybold and Pfeiffer Vacuum, have been supplying advanced sputtering equipment with real-time process monitoring, facilitating tighter process windows and better repeatability for fine film fabrication. These advancements are crucial for industries aiming to produce sub-10 nm VN films for next-generation semiconductor devices.

Chemical Vapor Deposition (CVD) methods, including both thermal and plasma-enhanced variants, are gaining traction due to their capability for conformal coatings on complex 3D structures. Companies like ULVAC are actively developing CVD systems optimized for transition metal nitrides, focusing on process uniformity at the wafer scale. In-situ diagnostics and closed-loop gas flow control are being integrated to improve stoichiometry and surface smoothness, both critical for device reliability in advanced electronics and battery applications.

Atomic Layer Deposition (ALD) has emerged as a key technology for ultra-fine VN film growth, enabling angstrom-level thickness control and exceptional step coverage even on high aspect ratio substrates. Equipment manufacturers such as Beneq are expanding their ALD toolsets to address the demand for precision nitrides. In 2025, process optimization efforts are focused on precursor selection, pulse timing, and reactor design to minimize impurities and maximize throughput, addressing both research and industrial-scale needs.

Looking ahead, the integration of machine learning and artificial intelligence for process optimization is expected to accelerate. Smart control systems that analyze real-time process data and adjust parameters dynamically are under development, promising further gains in yield and consistency. As the push for ever-thinner and more reliable coatings intensifies, partnerships between equipment suppliers, wafer fabs, and end-users will be critical. The outlook for 2025 and beyond is marked by a convergence of advanced deposition hardware, sophisticated process control, and data-driven optimization, setting the stage for continued innovation in fine vanadium nitride film technology.

Εξέλιξη Εφοδιαστικής Αλυσίδας: Πρώτες Ύλες και Βιωσιμότητα

The supply chain for fine vanadium nitride (VN) film deposition technologies is undergoing significant evolution as the demand for advanced thin films in microelectronics, hard coatings, and energy storage applications accelerates. In 2025, the focus is on securing sustainable and high-purity vanadium sources, improving precursor logistics, and integrating circular economy principles into VN film production.

Vanadium nitride films are typically deposited using physical vapor deposition (PVD) and chemical vapor deposition (CVD) methods, both requiring ultra-high-purity vanadium and precise nitrogen delivery. Leading global vanadium suppliers such as Bushveld Minerals and Largo Inc. are intensifying efforts to secure reliable vanadium feedstock by expanding mining operations and optimizing recovery from secondary sources, including waste catalysts and steel slag. These strategies not only ensure a steady supply for film manufacturers but also contribute to resource efficiency and reduced environmental impact.

To address growing environmental scrutiny, industry participants are increasingly prioritizing sustainable sourcing. For example, Treibacher Industrie AG emphasizes closed-loop recycling and responsible sourcing policies to minimize the carbon footprint of vanadium intermediates. Simultaneously, companies are investing in advanced refining and purification technologies to deliver the ultra-high-purity vanadium (≥99.9%) required for defect-free VN films, with a growing shift toward green hydrogen as a reducing agent in hydrometallurgical processes.

Nitrogen, the other critical input, is typically supplied in high-purity gaseous or plasma-activated forms. Industrial gas majors like Air Liquide and Linde are expanding their specialty gas portfolios and enhancing supply chain resilience through regional production hubs. This enables just-in-time delivery for semiconductor fabs and coating facilities in Asia, Europe, and North America.

Looking ahead, the VN film supply chain is set to benefit from digitalization, with traceability solutions and blockchain-enabled certification rapidly gaining traction to verify the provenance and sustainability credentials of vanadium raw materials. In parallel, industry consortia and standards bodies are collaborating to define best practices for environmental stewardship and material efficiency across the vanadium value chain.

Overall, the evolution of the supply chain for vanadium nitride film deposition technologies in 2025 reflects a broader industry commitment to sustainable growth, resource security, and the responsible adoption of advanced materials manufacturing.

Κανονιστικό Πλαίσιο και Βιομηχανικά Πρότυπα

The regulatory landscape for fine vanadium nitride (VN) film deposition technologies is evolving in response to the growing demand for advanced coatings in sectors such as microelectronics, hard coatings, energy storage, and catalysis. As of 2025, the industry is seeing increased scrutiny and harmonization of safety, environmental, and quality standards, largely driven by the dual imperatives of high-performance demands and sustainability.

Key international standards relevant to VN film deposition include ISO 9001 for quality management and ISO 14001 for environmental management. Leading equipment manufacturers and thin film suppliers—such as ULVAC and PVD Products—typically align with these standards, ensuring that their deposition systems and processes meet stringent, globally recognized requirements. Moreover, process-specific standards under ISO/TC 107 (Metallic and other inorganic coatings) are increasingly referenced, with attention to thin film uniformity, composition control, and process traceability.

Environmental regulations are particularly salient for vanadium-based films due to the toxicity of vanadium compounds in certain forms. Regulatory agencies in the US (such as the Environmental Protection Agency) and the European Union (through REACH and RoHS directives) are monitoring emissions, effluents, and chemical handling associated with physical vapor deposition (PVD), chemical vapor deposition (CVD), and atomic layer deposition (ALD) processes. Companies in the sector are responding with closed-system deposition technologies, enhanced filtration, and recycling protocols to minimize environmental impact and comply with evolving rules.

Worker safety is another regulatory focus, with organizations such as the US Occupational Safety and Health Administration providing guidance on exposure limits and handling procedures for vanadium precursors and process byproducts. Equipment suppliers increasingly offer integrated safety interlocks, real-time monitoring, and remote diagnostics to align with these requirements.

By 2025 and into the coming years, a notable trend is the movement toward digital traceability and automated compliance documentation. As the complexity of multilayer and nanostructured VN films increases, both regulators and downstream customers are seeking more granular data on process conditions and material provenance. This is leading manufacturers to invest in Industry 4.0-compatible deposition platforms, facilitating real-time data collection and audit readiness.

Looking ahead, continued convergence of global standards and best practices is expected, especially as vanadium nitride films find broader application in next-generation batteries, wear-resistant coatings, and semiconductor devices. Collaboration among equipment manufacturers, material suppliers, and regulatory bodies will likely intensify, ensuring that deposition technologies not only deliver high performance but also meet the increasingly rigorous safety and environmental benchmarks required by industry and society.

Αναδυόμενες Τάσεις και Διαταραγμένη Έρευνα & Ανάπτυξη

The landscape of fine vanadium nitride (VN) film deposition technologies is undergoing rapid transformation, propelled by evolving demands in microelectronics, energy storage, and advanced coatings. As of 2025, research and development in this sector is characterized by a surge in both fundamental innovations and pilot-scale commercialization, particularly in the pursuit of films with superior uniformity, tunable stoichiometry, and scalability for industrial applications.

Physical vapor deposition (PVD) techniques, especially reactive magnetron sputtering, remain foundational to VN thin film fabrication. Key equipment manufacturers, such as Leybold and ULVAC, have recently introduced sputtering systems with improved plasma control and substrate heating capabilities, enabling deposition of ultra-smooth VN films below 10 nm thickness. Parallel to PVD, atomic layer deposition (ALD) is gaining momentum due to its atomic-scale precision and ability to coat complex 3D architectures, meeting the miniaturization needs of next-generation semiconductor devices.

A notable development in 2025 is the refinement of plasma-enhanced ALD (PEALD) for vanadium nitride. This approach leverages plasma activation to facilitate nitridation at lower substrate temperatures, a critical requirement for integrating VN coatings on temperature-sensitive substrates. Leading ALD toolmakers such as Beneq and Oxford Instruments are expanding their PEALD portfolios to offer VN-specific process modules, highlighting industry momentum toward scalable, conformal coatings for microelectronic and battery-related applications.

Material synthesis is also being complemented by advances in in-situ monitoring and process automation. Real-time ellipsometry and mass spectrometry, now standard options in deposition platforms from PVD Products, are enabling unprecedented control of VN film growth, allowing rapid feedback and process optimization. The integration of machine learning algorithms for parameter tuning is anticipated to further accelerate the translation of lab-scale breakthroughs into commercial-scale production within the next few years.

Looking ahead, collaborative consortia between equipment suppliers, specialty materials companies, and semiconductor manufacturers are expected to play a pivotal role in driving disruptive R&D. The ongoing focus is on reducing process temperatures, enhancing throughput, and minimizing precursor toxicity, in alignment with the stringent requirements of advanced node device manufacturing and sustainable production. As such, the VN thin film sector is poised for significant breakthroughs that will enable broader adoption in high-performance electronics and energy systems by the late 2020s.

Στρατηγική Προοπτική: Ευκαιρίες και Προκλήσεις για το Μέλλον

The landscape for fine vanadium nitride (VN) film deposition technologies is poised for significant evolution through 2025 and the subsequent years, shaped by growing demand in advanced microelectronics, hard coatings, and energy storage applications. As industries increasingly require materials with superior hardness, chemical stability, and electronic properties, VN films are emerging as critical components, particularly in semiconductor devices and cutting tools.

In 2025, the primary deposition techniques—such as reactive magnetron sputtering, chemical vapor deposition (CVD), and atomic layer deposition (ALD)—continue to advance, with key industry players investing heavily in process optimization. Magnetron sputtering remains the most widely adopted industrial method due to its scalability and ability to produce dense, uniform VN films at relatively low temperatures. Companies like ULVAC, Inc. and Oxford Instruments are expanding their sputtering equipment portfolios to address the growing fine VN film market, catering to both research and mass manufacturing sectors.

Atomic layer deposition, while slower in throughput, is gaining traction owing to its atomic-level control over film thickness and composition, which is critical for next-generation nanoelectronics and wear-resistant coatings. Equipment manufacturers such as Beneq Oy are actively developing ALD systems tailored for transition metal nitride films, including vanadium nitride, as the microelectronics industry demands increasingly precise material interfaces.

The outlook for the coming years includes several opportunities. The proliferation of electric vehicles and renewable energy storage systems is driving research into VN-coated electrodes, where the high conductivity and chemical inertness of vanadium nitride can improve battery longevity and performance. Moreover, fine VN films are being explored for their potential in superconducting quantum devices and advanced MEMS sensors. As a result, collaborations between equipment manufacturers and end-user industries are expected to accelerate, with joint ventures and consortia focusing on process integration and reliability.

However, challenges remain. Achieving uniform, ultra-thin VN coatings over complex three-dimensional substrates is a persistent technical hurdle, especially as device architectures shrink. Controlling stoichiometry and minimizing defects require continual advances in precursor chemistry and plasma control. Additionally, the supply chain for high-purity vanadium precursors must be robust and sustainable, as demand increases in parallel sectors such as steel and catalyst manufacturing.

Regulatory and environmental considerations are also shaping the strategic direction. Deposition processes are under scrutiny for energy efficiency and waste management, prompting equipment makers to innovate in process monitoring and abatement technologies. Companies with a strong emphasis on sustainability and process automation, such as Linde plc (for process gases) and AMSC (advanced materials), are likely to play influential roles as the industry matures.

In summary, the strategic outlook for fine vanadium nitride film deposition technologies through 2025 and beyond is characterized by accelerating innovation, expanding application domains, and a concerted effort to overcome technical and environmental challenges. The sector is set for robust growth, contingent on continued collaboration across the value chain and sustained investment in both equipment and material science.

Πηγές & Αναφορές

- ULVAC

- Oxford Instruments

- Buehler

- Thermo Fisher Scientific

- American Elements

- Alfa Aesar

- Sumitomo Chemical

- Hitachi High-Tech Corporation

- Hardide Coatings

- Beneq

- Plassys

- Advanced Micro-Fabrication Equipment Inc. (AMEC)

- Treibacher Industrie AG

- Veeco Instruments

- Leybold

- Pfeiffer Vacuum

- Bushveld Minerals

- Air Liquide

- Linde

- PVD Products

- Oxford Instruments

- AMSC