Nanoplasmonic Sensor Fabrication in 2025: Unleashing a New Era of Ultra-Sensitive Detection and Scalable Manufacturing. Explore How Advanced Techniques Are Shaping the Future of Sensing Technologies.

- Executive Summary and Key Findings

- Market Size, Growth Forecasts, and CAGR (2025–2030)

- Core Nanoplasmonic Sensor Technologies and Fabrication Methods

- Key Players and Industry Initiatives (e.g., Thermo Fisher Scientific, Hamamatsu, IEEE.org)

- Emerging Applications: Healthcare, Environmental Monitoring, and IoT

- Materials Innovation: Advances in Nanostructures and Surface Engineering

- Manufacturing Scalability and Cost Reduction Strategies

- Regulatory Landscape and Standardization Efforts

- Competitive Analysis and Strategic Partnerships

- Future Outlook: Disruptive Trends and Investment Opportunities

- Sources & References

Executive Summary and Key Findings

Nanoplasmonic sensor fabrication is entering a pivotal phase in 2025, marked by rapid advancements in nanofabrication techniques, material innovation, and integration with microelectronics. These sensors, which exploit the unique optical properties of metallic nanostructures to detect minute changes in the local environment, are increasingly being adopted in biomedical diagnostics, environmental monitoring, and industrial process control. The current landscape is shaped by a convergence of scalable manufacturing methods, such as nanoimprint lithography, electron-beam lithography, and advanced self-assembly, enabling both high sensitivity and cost-effective production.

Key industry players are accelerating the commercialization of nanoplasmonic sensors. Thermo Fisher Scientific continues to expand its nanofabrication capabilities, supporting both research and industrial-scale sensor production. Oxford Instruments is advancing electron-beam lithography systems, which are critical for fabricating high-resolution plasmonic nanostructures. Meanwhile, Nanoscribe is pioneering two-photon polymerization for 3D nanostructure printing, opening new avenues for complex sensor architectures.

Recent data from 2024 and early 2025 indicate a surge in demand for label-free, real-time biosensing platforms, particularly in point-of-care diagnostics and pandemic preparedness. The integration of nanoplasmonic sensors with CMOS-compatible processes is a notable trend, as seen in collaborative efforts between sensor manufacturers and semiconductor foundries. This integration is expected to drive down costs and facilitate mass production, making nanoplasmonic sensors more accessible for widespread deployment.

Material innovation is another key driver. The adoption of alternative plasmonic materials, such as aluminum and copper, is being explored to replace traditional gold and silver, aiming to reduce costs and improve compatibility with existing manufacturing infrastructure. Companies like HORIBA are investing in research to optimize these materials for enhanced sensitivity and stability in harsh environments.

Looking ahead, the next few years are expected to witness further miniaturization, multiplexing capabilities, and integration with digital platforms for data analytics and remote monitoring. The outlook for nanoplasmonic sensor fabrication is robust, with ongoing investments in R&D, strategic partnerships, and a growing emphasis on scalable, sustainable manufacturing. As regulatory pathways for medical and environmental sensors become clearer, the sector is poised for accelerated adoption and innovation through 2025 and beyond.

Market Size, Growth Forecasts, and CAGR (2025–2030)

The global market for nanoplasmonic sensor fabrication is poised for robust growth from 2025 through 2030, driven by expanding applications in healthcare diagnostics, environmental monitoring, food safety, and industrial process control. As of 2025, the sector is witnessing increased investment in scalable manufacturing techniques, such as nanoimprint lithography, electron-beam lithography, and advanced self-assembly methods, which are enabling higher throughput and cost-effective production of nanoplasmonic devices.

Key industry players are scaling up their fabrication capabilities to meet rising demand. Thermo Fisher Scientific and HORIBA are notable for their integrated solutions in nanofabrication and plasmonic sensor platforms, supporting both research and commercial deployment. Oxford Instruments continues to advance its portfolio of plasma etching and deposition systems, which are critical for precise nanostructure fabrication. Meanwhile, ams-OSRAM is leveraging its expertise in photonic and sensor integration to develop next-generation plasmonic sensor modules for medical and industrial markets.

Recent data from industry sources and company reports indicate that the nanoplasmonic sensor fabrication market is expected to achieve a compound annual growth rate (CAGR) in the range of 18–22% between 2025 and 2030. This growth is underpinned by the increasing adoption of point-of-care diagnostic devices, where nanoplasmonic sensors offer rapid, label-free detection of biomolecules with high sensitivity. The Asia-Pacific region, led by manufacturing hubs in China, Japan, and South Korea, is anticipated to experience the fastest expansion, supported by government initiatives and investments in nanotechnology infrastructure.

In the next few years, the market outlook is further strengthened by collaborations between equipment manufacturers and end-users to co-develop application-specific sensor solutions. For example, Carl Zeiss is working with academic and industrial partners to refine nanofabrication processes for biosensing and environmental monitoring. Additionally, the emergence of flexible and wearable plasmonic sensors is opening new commercial avenues, with companies like Lam Research providing advanced etching and deposition tools tailored for novel substrate materials.

Overall, the nanoplasmonic sensor fabrication market is set for dynamic growth through 2030, propelled by technological innovation, expanding application fields, and the ongoing push for miniaturized, high-performance sensing platforms.

Core Nanoplasmonic Sensor Technologies and Fabrication Methods

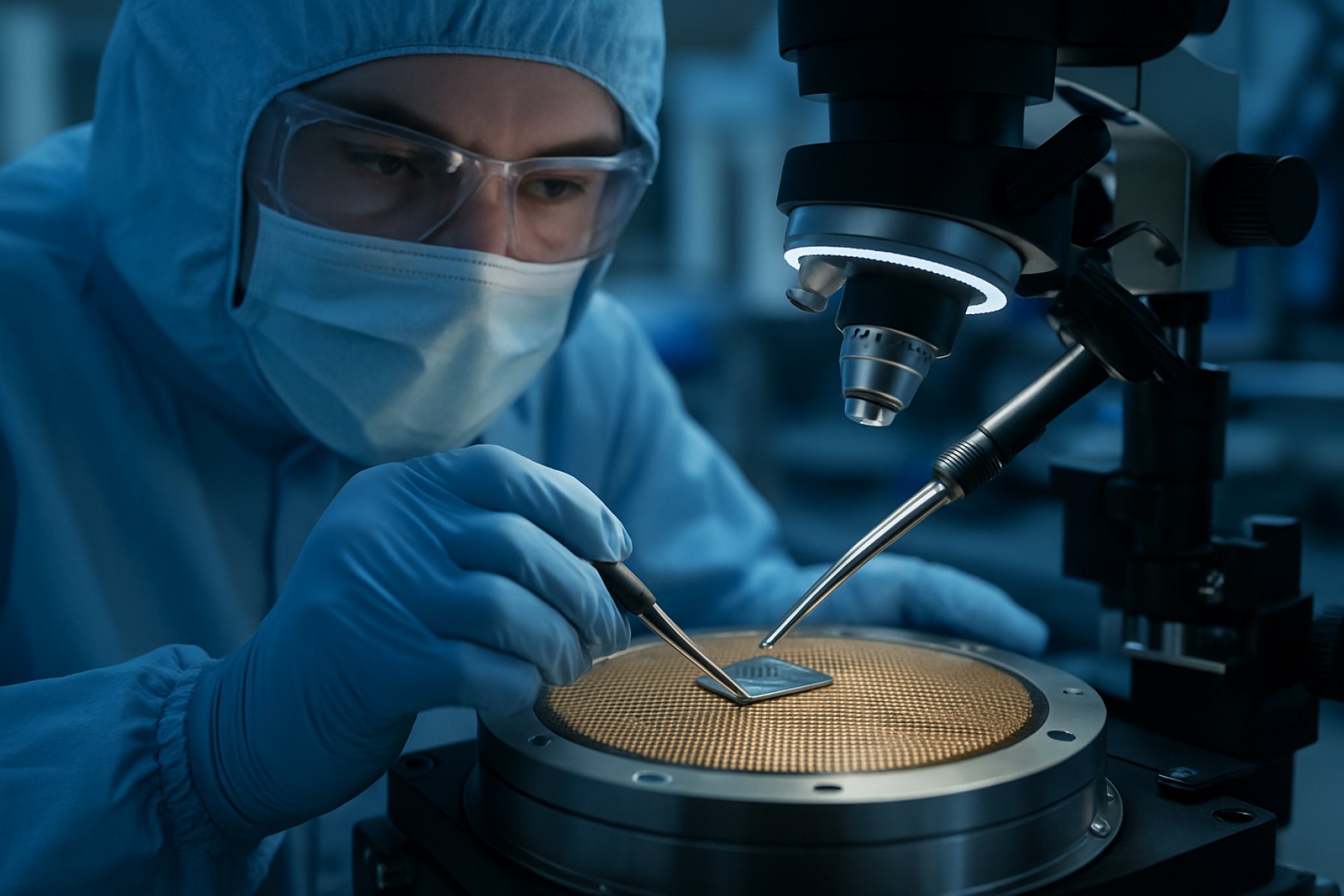

Nanoplasmonic sensor fabrication is at the forefront of advanced sensing technologies, leveraging the unique optical properties of metallic nanostructures to achieve high sensitivity and specificity. As of 2025, the field is characterized by rapid innovation in both materials and manufacturing techniques, driven by the demand for scalable, reproducible, and cost-effective sensor platforms for applications in healthcare, environmental monitoring, and industrial process control.

The core of nanoplasmonic sensor fabrication lies in the precise engineering of metallic nanostructures—primarily gold and silver—on substrates such as glass, silicon, or flexible polymers. Traditional top-down lithographic methods, including electron-beam lithography (EBL) and focused ion beam (FIB) milling, remain the gold standard for producing highly ordered arrays with nanometer-scale resolution. These techniques are widely used in research and pilot-scale production, with companies like JEOL Ltd. and Thermo Fisher Scientific supplying advanced EBL and FIB systems to both academic and industrial labs.

However, the high cost and limited throughput of top-down methods have spurred the adoption of alternative, scalable approaches. Nanoimprint lithography (NIL) has gained significant traction, enabling the replication of nanostructured patterns over large areas with high fidelity and lower cost. Nanonex and Obducat are notable providers of NIL equipment, supporting the transition from prototyping to mass production. Additionally, self-assembly techniques, such as colloidal lithography and block copolymer templating, are being refined to fabricate plasmonic nanostructures with tunable geometries, offering a pathway to low-cost, high-throughput manufacturing.

Material innovation is another key trend. While gold and silver remain dominant due to their favorable plasmonic properties, research into alternative materials—such as aluminum for UV plasmonics and copper for cost-sensitive applications—is ongoing. Companies like MilliporeSigma (the U.S. life science business of Merck KGaA) supply a broad range of high-purity nanomaterials tailored for sensor fabrication.

Looking ahead, integration with complementary technologies is expected to accelerate. Roll-to-roll processing and inkjet printing are being explored for flexible and wearable nanoplasmonic sensors, with companies such as NovaCentrix advancing conductive nanoparticle inks and printing systems. The convergence of nanofabrication with microfluidics and photonics is also anticipated to yield multifunctional sensor platforms, broadening the scope of real-world applications.

In summary, nanoplasmonic sensor fabrication in 2025 is defined by a dynamic interplay between precision, scalability, and material innovation. The ongoing efforts of equipment manufacturers, material suppliers, and integrators are poised to make nanoplasmonic sensors more accessible and impactful across diverse sectors in the coming years.

Key Players and Industry Initiatives (e.g., Thermo Fisher Scientific, Hamamatsu, IEEE.org)

The nanoplasmonic sensor fabrication sector in 2025 is characterized by a dynamic interplay between established instrumentation giants, specialized nanotechnology firms, and collaborative industry-academic initiatives. Key players are leveraging advanced lithography, nanoimprint, and self-assembly techniques to push the boundaries of sensitivity, scalability, and integration for biosensing, environmental monitoring, and industrial process control.

Among the most influential companies, Thermo Fisher Scientific continues to expand its nanofabrication capabilities, offering a suite of electron microscopy and focused ion beam (FIB) systems that are widely used for prototyping and quality control of nanoplasmonic structures. Their platforms enable precise patterning and characterization at the sub-10 nm scale, which is critical for reproducible sensor performance. In parallel, Hamamatsu Photonics remains a leader in optoelectronic components, supplying high-sensitivity photodetectors and light sources that are integral to the readout systems of plasmonic sensors. Hamamatsu’s ongoing R&D in photonic integration and miniaturization is expected to further enhance the commercial viability of portable nanoplasmonic devices.

On the materials and fabrication front, Oxford Instruments provides advanced plasma etching and deposition tools, supporting both research and industrial-scale production of nanostructured plasmonic films. Their systems are widely adopted for fabricating gold and silver nanostructures with controlled morphology, a key determinant of sensor sensitivity and selectivity. Meanwhile, Nanoscribe specializes in high-resolution 3D laser lithography, enabling the creation of complex plasmonic architectures that are difficult to achieve with conventional planar techniques.

Industry consortia and standards bodies are also playing a pivotal role. The IEEE Nanotechnology Council is actively fostering collaboration between academia and industry, promoting best practices in nanofabrication and sensor integration. Their technical committees are working towards standardizing performance metrics and reliability testing for nanoplasmonic sensors, which is expected to accelerate regulatory acceptance and market adoption.

Looking ahead, the next few years will likely see increased investment in scalable manufacturing methods, such as roll-to-roll nanoimprint lithography and self-assembly, to meet the growing demand for cost-effective, high-throughput sensor production. Strategic partnerships between equipment manufacturers, materials suppliers, and end-users are anticipated to drive innovation, particularly in the integration of nanoplasmonic sensors with microfluidic and photonic platforms for real-time, multiplexed detection applications.

Emerging Applications: Healthcare, Environmental Monitoring, and IoT

Nanoplasmonic sensor fabrication is rapidly advancing, driven by the growing demand for highly sensitive, miniaturized, and cost-effective sensing platforms in healthcare, environmental monitoring, and the Internet of Things (IoT). In 2025, the field is witnessing a convergence of scalable nanofabrication techniques and integration with microelectronics, enabling new applications and commercial products.

Key fabrication methods include electron beam lithography, nanoimprint lithography, and colloidal self-assembly, each offering distinct advantages in terms of resolution, throughput, and cost. Recent developments have focused on large-area, reproducible fabrication to meet the needs of mass deployment. For example, ams-OSRAM AG, a leader in optical sensor solutions, has invested in scalable nanofabrication processes to produce plasmonic chips for biosensing and environmental analysis. Their platforms leverage advanced lithography and thin-film deposition to achieve high sensitivity and batch-to-batch consistency.

In healthcare, nanoplasmonic sensors fabricated using gold and silver nanostructures are being integrated into point-of-care diagnostic devices. Companies such as HORIBA, Ltd. are developing surface plasmon resonance (SPR) and localized surface plasmon resonance (LSPR) sensors for rapid detection of biomarkers, pathogens, and drug molecules. These sensors benefit from precise nanostructure control, enabling detection limits down to the single-molecule level. The trend toward disposable, chip-based formats is accelerating, with roll-to-roll nanoimprint lithography emerging as a preferred method for high-volume production.

Environmental monitoring is another area where nanoplasmonic sensor fabrication is making significant strides. Thermo Fisher Scientific Inc. is exploring integration of nanoplasmonic arrays into portable analyzers for real-time detection of pollutants and toxins. The use of robust, chemically stable nanostructures—often fabricated via template-assisted methods—ensures sensor durability in harsh field conditions. The ability to mass-produce these sensors at low cost is critical for widespread deployment in air and water quality monitoring networks.

Looking ahead, the integration of nanoplasmonic sensors with IoT platforms is expected to accelerate. Companies like ams-OSRAM AG and HORIBA, Ltd. are actively developing sensor modules with wireless connectivity and on-chip data processing. Advances in wafer-scale fabrication and hybrid integration with CMOS electronics are anticipated to further reduce costs and enable seamless incorporation into smart devices and distributed sensor networks. As fabrication technologies mature, the next few years will likely see nanoplasmonic sensors become ubiquitous in applications ranging from wearable health monitors to autonomous environmental sensing nodes.

Materials Innovation: Advances in Nanostructures and Surface Engineering

The fabrication of nanoplasmonic sensors is undergoing rapid transformation in 2025, driven by advances in materials science and surface engineering. Central to these innovations is the development of novel nanostructures—such as nanohole arrays, nanopillars, and nanodisks—engineered to enhance localized surface plasmon resonance (LSPR) sensitivity and specificity. Gold and silver remain the dominant materials due to their favorable plasmonic properties, but recent years have seen the emergence of alternative materials like aluminum and copper, which offer cost and stability advantages for large-scale sensor deployment.

A key trend in 2025 is the integration of bottom-up and top-down fabrication techniques. Electron beam lithography (EBL) and focused ion beam (FIB) milling continue to provide high-resolution patterning capabilities, enabling the creation of complex nanostructures with feature sizes below 20 nm. However, these methods are being complemented by scalable approaches such as nanoimprint lithography (NIL) and self-assembly, which are essential for commercial viability. Companies like Nanoscribe GmbH are at the forefront, offering two-photon polymerization systems that allow for rapid prototyping and direct laser writing of 3D nanostructures with sub-micron precision.

Surface functionalization remains a critical aspect of sensor performance. In 2025, there is a growing emphasis on atomic layer deposition (ALD) and molecular self-assembly to achieve uniform, defect-free coatings that enhance biocompatibility and reduce nonspecific binding. Oxford Instruments and Entegris, Inc. are notable suppliers of ALD equipment and advanced surface treatment solutions, supporting the reproducible fabrication of high-performance plasmonic devices.

Another significant development is the adoption of hybrid nanomaterials, such as graphene-gold composites and dielectric-metal heterostructures, which offer tunable plasmonic responses and improved chemical stability. These materials are being explored for multiplexed sensing platforms and integration with microfluidic systems, expanding the application range of nanoplasmonic sensors in healthcare, environmental monitoring, and food safety.

Looking ahead, the outlook for nanoplasmonic sensor fabrication is marked by increasing automation, in-line quality control, and the use of artificial intelligence for process optimization. Industry leaders like Thermo Fisher Scientific and HORIBA, Ltd. are investing in advanced instrumentation for real-time monitoring and characterization of nanostructures, ensuring consistent sensor performance at scale. As these technologies mature, the next few years are expected to bring further reductions in production costs and broader adoption of nanoplasmonic sensors across diverse industries.

Manufacturing Scalability and Cost Reduction Strategies

The drive toward scalable and cost-effective nanoplasmonic sensor fabrication is intensifying in 2025, as demand grows for high-performance, miniaturized sensors in healthcare, environmental monitoring, and industrial process control. Traditional fabrication methods—such as electron-beam lithography (EBL) and focused ion beam (FIB) milling—offer exceptional precision but are limited by low throughput and high operational costs, restricting their use to prototyping and niche applications. To address these challenges, industry leaders and research-driven manufacturers are accelerating the adoption of alternative, scalable techniques.

Nanoimprint lithography (NIL) has emerged as a frontrunner for mass production, enabling the replication of nanostructures over large areas with sub-10 nm resolution. Companies like NIL Technology are commercializing advanced NIL tools and master templates, supporting both R&D and industrial-scale manufacturing. NIL’s compatibility with roll-to-roll (R2R) processing further enhances its appeal for high-volume, flexible substrate production, a trend expected to expand through 2025 and beyond.

Colloidal lithography and self-assembly methods are also gaining traction for their low material and equipment costs. These bottom-up approaches, championed by suppliers such as Sigma-Aldrich (now part of Merck KGaA), enable the formation of plasmonic nanostructures using nanoparticles or block copolymers, offering a pathway to affordable, large-area sensor arrays. While these methods may sacrifice some precision compared to top-down lithography, ongoing process optimization is narrowing the performance gap.

Laser interference lithography (LIL) is another promising technique, providing rapid, maskless patterning of periodic nanostructures. Equipment manufacturers like SÜSS MicroTec are developing LIL systems tailored for sensor fabrication, emphasizing throughput and reproducibility. Hybrid approaches—combining NIL, LIL, and self-assembly—are being explored to balance cost, scalability, and device performance.

Material selection and process integration are also focal points for cost reduction. The use of alternative plasmonic materials, such as aluminum and copper, is being investigated to replace gold and silver, which are expensive and less compatible with CMOS processes. Companies like Umicore supply high-purity metals and nanomaterials, supporting these material innovations.

Looking ahead, the convergence of scalable nanofabrication, automation, and in-line quality control is expected to further reduce costs and enable the widespread deployment of nanoplasmonic sensors. Industry collaborations and standardization efforts, led by organizations such as SEMI, are anticipated to accelerate technology transfer from lab to fab, ensuring that nanoplasmonic sensor manufacturing meets the demands of emerging markets through 2025 and the following years.

Regulatory Landscape and Standardization Efforts

The regulatory landscape and standardization efforts surrounding nanoplasmonic sensor fabrication are rapidly evolving as these devices transition from research laboratories to commercial and clinical applications. In 2025, regulatory bodies and industry consortia are increasingly focused on establishing clear guidelines to ensure the safety, reliability, and interoperability of nanoplasmonic sensors, particularly as they are integrated into medical diagnostics, environmental monitoring, and industrial process control.

A key driver in this space is the growing adoption of nanoplasmonic sensors in point-of-care diagnostics and biosensing platforms. Regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are actively engaging with manufacturers to define requirements for device characterization, reproducibility, and biocompatibility. In 2024 and 2025, the FDA has increased its focus on the validation of nanomaterial-based devices, emphasizing the need for standardized protocols in fabrication and quality control to facilitate premarket approval processes.

On the standardization front, organizations like the International Organization for Standardization (ISO) and the ASTM International are working to develop and update standards specific to nanomaterials and nanofabrication techniques. ISO’s Technical Committee 229 (Nanotechnologies) and ASTM’s Committee E56 (Nanotechnology) are both actively soliciting input from industry leaders and academic experts to address the unique challenges posed by nanoplasmonic sensor fabrication, such as surface functionalization, batch-to-batch consistency, and long-term stability.

Industry consortia and alliances are also playing a pivotal role. The SEMI association, known for its work in micro- and nanofabrication standards, has initiated working groups in 2025 to address the integration of nanoplasmonic components into semiconductor manufacturing lines. These efforts aim to harmonize fabrication protocols and testing methodologies, which is critical for scaling up production and ensuring device interoperability across different platforms.

Looking ahead, the next few years are expected to see increased collaboration between regulatory agencies, standards bodies, and manufacturers. Companies such as Thermo Fisher Scientific and HORIBA, both active in supplying nanoplasmonic sensor components and systems, are participating in pilot programs to demonstrate compliance with emerging standards. The outlook for 2025 and beyond suggests that as regulatory clarity improves and standardized fabrication protocols are adopted, the commercialization of nanoplasmonic sensors will accelerate, particularly in healthcare and environmental sectors.

Competitive Analysis and Strategic Partnerships

The competitive landscape for nanoplasmonic sensor fabrication in 2025 is characterized by a dynamic interplay between established photonics manufacturers, innovative startups, and strategic alliances with research institutions. The sector is driven by the demand for highly sensitive, miniaturized sensors for applications in healthcare diagnostics, environmental monitoring, and industrial process control. Key players are leveraging advanced nanofabrication techniques—such as electron-beam lithography, nanoimprint lithography, and self-assembly—to achieve reproducible, scalable, and cost-effective production of nanoplasmonic structures.

Among the global leaders, Hamamatsu Photonics stands out for its extensive portfolio of photonic devices and its ongoing investment in plasmonic sensor R&D. The company collaborates with academic and industrial partners to integrate nanoplasmonic elements into photodetectors and biosensing platforms. Similarly, Carl Zeiss AG leverages its expertise in electron and ion beam systems to provide nanofabrication solutions tailored for plasmonic sensor prototyping and small-batch production, supporting both internal development and external partnerships.

Startups and SMEs are also shaping the competitive landscape. For example, LioniX International specializes in integrated photonics and has developed proprietary processes for fabricating nanostructured surfaces, enabling the commercialization of compact, chip-based plasmonic sensors. Their collaborative projects with universities and medical device companies are accelerating the translation of lab-scale innovations to market-ready products.

Strategic partnerships are a defining feature of the sector in 2025. Companies are forming consortia with research institutes and end-users to co-develop application-specific solutions. For instance, imec, a leading nanoelectronics R&D hub, partners with sensor manufacturers and healthcare providers to advance scalable nanoplasmonic sensor fabrication, focusing on point-of-care diagnostics and wearable biosensors. These collaborations often involve shared intellectual property, joint pilot lines, and coordinated access to advanced cleanroom facilities.

Looking ahead, the next few years are expected to see intensified competition as companies race to achieve higher sensitivity, multiplexing capability, and integration with microfluidics and electronics. The emergence of new materials—such as graphene and transition metal dichalcogenides—will likely spur further partnerships between material suppliers and sensor developers. Additionally, the push for mass production is prompting alliances with semiconductor foundries and contract manufacturers, aiming to bridge the gap between prototyping and high-volume manufacturing.

Overall, the nanoplasmonic sensor fabrication sector in 2025 is marked by a blend of technological innovation, cross-sector partnerships, and a strategic focus on scalable manufacturing, positioning it for significant growth and diversification in the coming years.

Future Outlook: Disruptive Trends and Investment Opportunities

The landscape of nanoplasmonic sensor fabrication is poised for significant transformation in 2025 and the coming years, driven by advances in materials science, scalable manufacturing, and integration with digital technologies. As demand for ultra-sensitive, miniaturized, and cost-effective sensors accelerates across healthcare, environmental monitoring, and industrial automation, several disruptive trends are emerging.

A key trend is the shift toward large-scale, reproducible fabrication methods. Traditional electron-beam lithography, while precise, is limited by throughput and cost. In response, companies are investing in nanoimprint lithography and roll-to-roll processing, which promise high-volume production of nanostructured plasmonic surfaces. For example, Nanoscribe GmbH & Co. KG is advancing two-photon polymerization for rapid prototyping and direct laser writing of complex nanostructures, enabling both research and commercial-scale sensor production. Similarly, ams-OSRAM AG is leveraging its expertise in photonic integration to develop scalable plasmonic sensor platforms for medical diagnostics and consumer electronics.

Material innovation is another focal point. While gold and silver remain standard for plasmonic structures, research is expanding into alternative materials such as aluminum, copper, and even graphene, which offer tunable optical properties and lower costs. Companies like Oxford Instruments plc are supplying advanced deposition and etching tools that facilitate the precise fabrication of these next-generation materials, supporting both academic and industrial R&D.

Integration with microfluidics and on-chip electronics is also accelerating. The convergence of nanoplasmonics with lab-on-a-chip technologies is enabling real-time, multiplexed detection of biomolecules and environmental contaminants. Thermo Fisher Scientific Inc. and HORIBA, Ltd. are actively developing platforms that combine plasmonic sensors with automated fluid handling and data analytics, targeting point-of-care diagnostics and portable sensing applications.

Looking ahead, investment opportunities are expected to concentrate on companies that can bridge the gap between laboratory innovation and industrial-scale manufacturing. Strategic partnerships between sensor developers, materials suppliers, and device integrators will be crucial. The ongoing miniaturization and digitalization of sensors, coupled with the push for sustainable and low-cost fabrication, are likely to drive both market growth and technological breakthroughs through 2025 and beyond.

Sources & References

- Thermo Fisher Scientific

- Oxford Instruments

- Nanoscribe

- HORIBA

- ams-OSRAM

- Carl Zeiss

- JEOL Ltd.

- Nanonex

- Obducat

- NovaCentrix

- Hamamatsu Photonics

- IEEE

- Entegris, Inc.

- SÜSS MicroTec

- Umicore

- European Medicines Agency

- International Organization for Standardization

- ASTM International

- LioniX International

- imec